Top-5 reasons why most EV charging Business don’t scale up

There have been numerous EV charging companies shoot-up like mushrooms across the world in the past decade. However, only a few have found their way to creating a scalable and sustainable business, while rest of the bigger crowd are still struggling to find the sweet spot in the dynamically changing EV charging ecosystem.

This article, written by Thomas Daiber (former Daimler, EnBW and Porsche Consulting, Hubject and now the founder of Mobility Masters & Cosmic Cat Group), and was originally published at electrive, shares top-5 observations on what made some companies to succeed and to struggle. (Credits to: Thomas Daiber & Electrive)

It’s is based on personal experience of the author - Thomas Daiber in the three leading electric vehicle markets – Europe, US & China. However, since these three markets heavily vary in structure, technical specifications, competitive pressure and market fragmentation, his observations below may hold good to part of the world.

This article, written by Thomas Daiber (former Daimler, EnBW and Porsche Consulting, Hubject and now the founder of Mobility Masters & Cosmic Cat Group), and was originally published at electrive, shares top-5 observations on what made some companies to succeed and to struggle. (Credits to: Thomas Daiber & Electrive)

It’s is based on personal experience of the author - Thomas Daiber in the three leading electric vehicle markets – Europe, US & China. However, since these three markets heavily vary in structure, technical specifications, competitive pressure and market fragmentation, his observations below may hold good to part of the world.

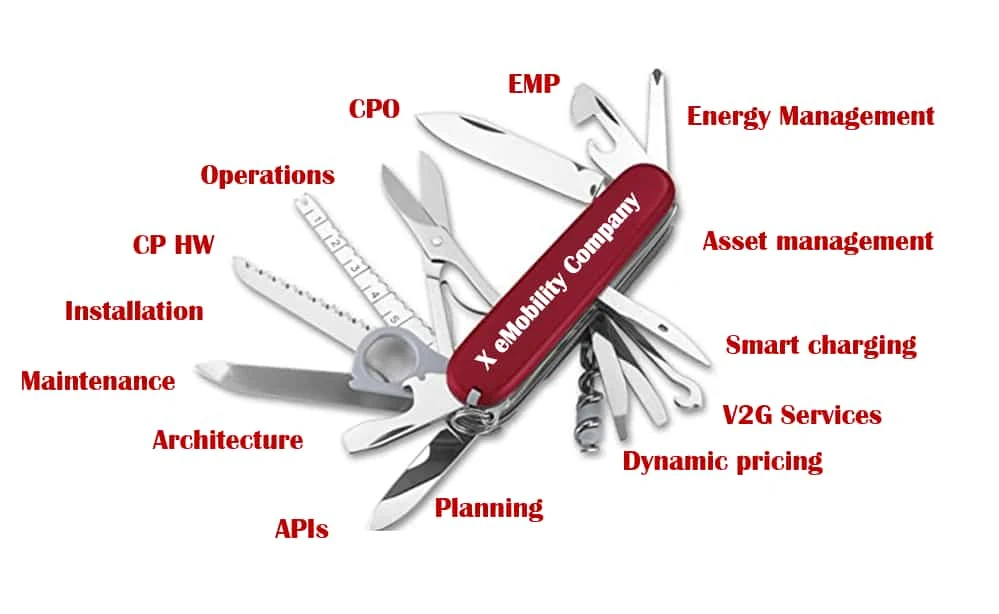

#1 Reason for failure: The Swiss pocket knife portfolio

With money and manpower limited, focusing on doing one thing really well rather than attempting to be a jack of all trades is the way to go for a new business.However, the majority of the European EV charging participants became entrenched in their bloated multi-layer ecosystems: planning, installation, asset management, operations, maintenance, CPO and EMP backend, smart charging service and V2G, dynamic pricing, multi-service architecture and APIs, some even create their own charging station, stepping-in as a charge point manufacturer and reseller…So, the list is not exhaustive. And this holds for B2B, B2C, and B2B2C.

If you’re busy juggling balls or customizing your solution to suit too many individual clients, you could lose speed dramatically. Whilst you continue to work this way, it is hard to build mindshare in a particular business niche with the aim of distinguishing your product from others.

Most EV charging companies built the Swiss pocket knife before they understood how to develop a simple bottle opener. Meanwhile, ambitious competitors focus on developing razor-sharp blades. Eventually, we find more immature pocket knives than single blades in the market, which makes it even easier for highly-specialized ventures to compete. Remember: Amazon started selling books online, PayPal became successful by creating a niche as a digital payment provider for eBay – then they set sail to conquer the world.

Let us do the math and take the example of Germany: for 48 million passenger cars, you currently find 14.k fuel stations across the country. The German government calculated demand of one million charging stations for 6 million electric vehicles for the year 2030, without further specifying what type of charging station and use case.

It is rather unlikely that this number is consistent, given that you believe in the further rollout of DC ultra-fast chargers and a charging use case that more and more converges to what we use when fueling up a combustion engine car. Not to forget the fact that a large percentage of EV drivers would still use only home charging and rarely visit a public charging point.

Most EV charging companies built the Swiss pocket knife before they understood how to develop a simple bottle opener. Meanwhile, ambitious competitors focus on developing razor-sharp blades. Eventually, we find more immature pocket knives than single blades in the market, which makes it even easier for highly-specialized ventures to compete. Remember: Amazon started selling books online, PayPal became successful by creating a niche as a digital payment provider for eBay – then they set sail to conquer the world.

#2 Reason for failure: The public charging tunnel vision

In nine out of ten charging business cases I have seen over the course of my career, public charging has been considered as the no.1 revenue stream. While both the size of electric car batteries and the provided charging power of charging stations are continually increasing, the characteristic use case for public infrastructure is about to change without prior notice drastically.Let us do the math and take the example of Germany: for 48 million passenger cars, you currently find 14.k fuel stations across the country. The German government calculated demand of one million charging stations for 6 million electric vehicles for the year 2030, without further specifying what type of charging station and use case.

It is rather unlikely that this number is consistent, given that you believe in the further rollout of DC ultra-fast chargers and a charging use case that more and more converges to what we use when fueling up a combustion engine car. Not to forget the fact that a large percentage of EV drivers would still use only home charging and rarely visit a public charging point.

#3 Reason for failure: The interoperability dogmatist

How to get access to chargers that are deployed by other operators? Go with a centralised roaming platform or connect P2P? Maybe use a blockchain (because it is hip 😊)?The interconnection with other EV charging players that might be your competitors has been one of the most polarising topics of recent years. Many companies have claimed the software gateway to provide interoperability as their battlefield of choice. They have put a lot of time and effort into the religious “war of words” on roaming protocol standards and possible market models. As they were putting all their energy into this holy crusade, they forgot that their end-users still couldn’t use a single station from third-party CPOs via their EMP solution.

In the meantime, tech-agnostic service providers found a pragmatic way by leveraging the interoperability solutions that were there and functioning (Hubject, Gireve, OCPI, centralised, decentralised, open standards, proprietary API for example). The result of this approach was a fast(er) network coverage, happy customers and eventually, a stronger market position.

Are the existing interoperability solutions such as roaming platforms or P2P protocols already perfect, and is that the end of the story? Not by far. Is the mix of parallel interoperability standards and frameworks destabilising your IT ecosystem and creating an overhead? Probably so.

Open secret: Pssssst…! Early-stage investors are saying that newly found P2P blockchain charging startups are beating a dead horse. Just using a decentralised software architecture to cut out the middleman might be a fair strategy. But it is definitely not a value proposition that brings a direct functional benefit for your customer. Besides, there are just way too many of them out there already…

#4 Reason for failure: The field sales opportunist

What is your most relevant target group, and why? What does your ‘dream buyer’ look like? Who are your A-customers that make 80% of your business? Which sales channels can gain sufficient access to these customer groups? What are your inbound channels for generating and qualifying leads? Are you focusing on B2B or B2C business?You might think that these are basic questions. Both entrepreneurs and sales managers must have convincing answers right from the start. In the emerging EV charging market in which even small municipal utilities offer their charging solution, your sales strategy and leveraging the right distribution channels becomes even more critical.

What seems to be significant about the EV charging industry is that many companies never pass the first stage of an opportunistic sales approach. As any prospect may be a good prospect, the lead generation is not focused and generates too much chaff and not enough wheat.

Don’t get me wrong. It might in fact make sense to go with the flow at the very start of your new business. An opportunistic sales strategy is better than no strategy at all, and it helps to get a feeling for the market and your future customers. However, the fact that companies dramatically overestimate their market position can be considered another characteristic attribute of the EV charging market. Companies tend to think that customers will find them due to their extensive professional network or a dominant position that derives from the core business.

My personal opinion is that this “magic inbound idea” might only work in a market where either the brand, community or product is far superior to that of competitors. Plus, you should already manage to set up the right inbound channels to market your product (take Tesla’s Model S or Apple’s iPhone as examples).

#5 Reason for failure: The (corporate) hamster investment

This is about strategic acquisitions as a fig leaf to cover the fact that you have not done your homework for years.How to strategically secure the evolving EV charging value chain and find your place in it? The first step is probably to understand, deconstruct and finally position your company in what you consider to be the epicentre of the value creation for your envisioned future business. Of course, this is easier said than done – in particular for companies with a commodity or hardware background and a limited track record in ramping up businesses with a digital edge.

Some car, oil and energy companies have made early forward-facing decisions to not only understand these new businesses but even become an active part of the value chain by creating their solutions. Why did most of these approaches fail before they even started?

Besides the cultural deficits of organisations that have been focusing on maintaining rather than creating for more than a century, the lack of internal expertise in these new disciplines is probably part of the answer. All spiced up with the immodest self-conception of a very thriving industry that has unlearned to learn. Eventually, the dedicated organisations and spin-offs were often put way too close to the mothership and have been instantly stuffed with corporate dinosaurs in the executive team. Of course, the exception proves the rule.

As it often takes years to acknowledge this failure, the competition has rushed off even further into the distance. Finally, there is no other option than either to acquire companies with the desired skill set or at least find a suitable supplier. Due to the lack of first-hand market experience in these corporate organisations, it is hard even to identify which company is the perfect target.

At the same time, internal political pressure increases every day. The final result is what many have called the ‘corporate panic buying mode’. It leads to an investment and supplier portfolio, which is characterised by strategic inconsistency and redundancies. In retrospect, of course, these failures are labelled as conscious ‘2nd source strategies’.

A very informative and precise article. Thanks for bringing this out.

ReplyDelete